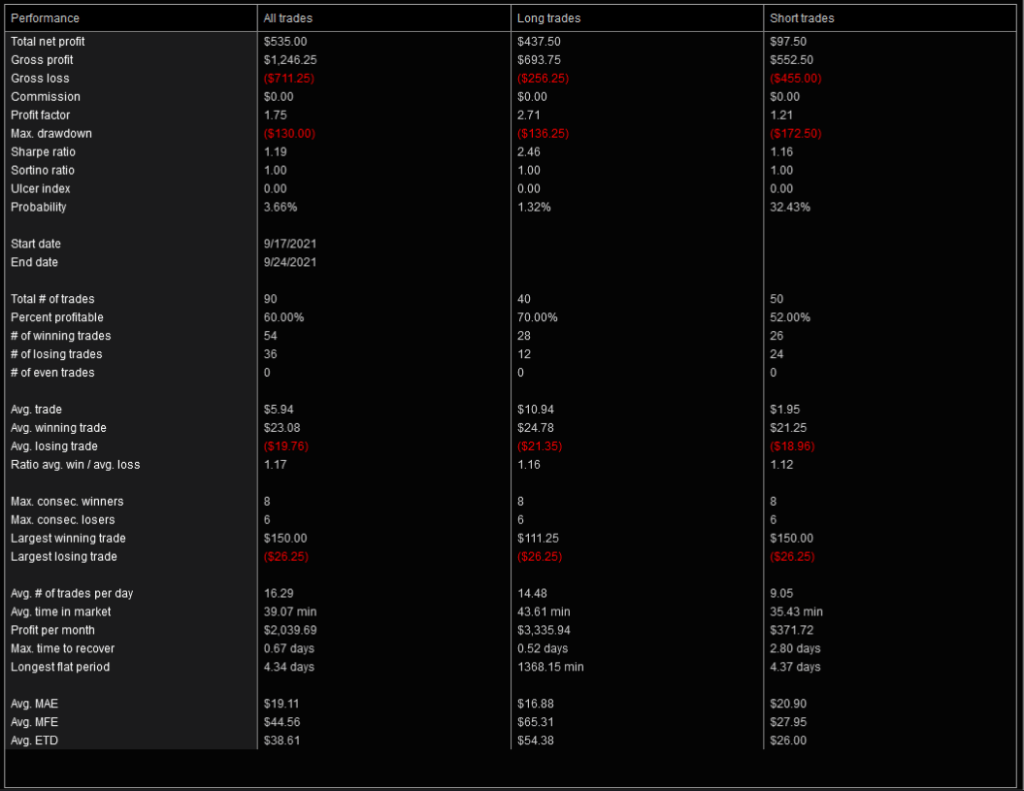

After much time and consideration to how I have been approaching trading I have been looking at and testing a new, much simpler approach to trading with the AlgoNinja Algorithm. Over the past 10-12 months I have been focused primarily on win % as the driving path, but as I learn and now realize there is an importance to things like average win vs. average loss ratios. With that I have been running live and testing a couple of different sets of settings, also testing some features on the new version of the algo.

One very powerful feature that has been added is a bar delay for order entry, this has really made a big difference and I have not seen this feature on any other algo yet. Here are some pictures of charts to show what I am saying:

In the case above the algo is set for a 3 bar delay, but this value can be set to anything that works for your trading style, you can see that this delay stopped the algo from taking a long trade that would have gone for a loss. Here is an example of a trade that did enter just to show the difference:

This is a real game changer, its also a benefit of going with AlgoNinja as the owner / programmer is also very open to new ideas, concepts and can program and implement very quickly.

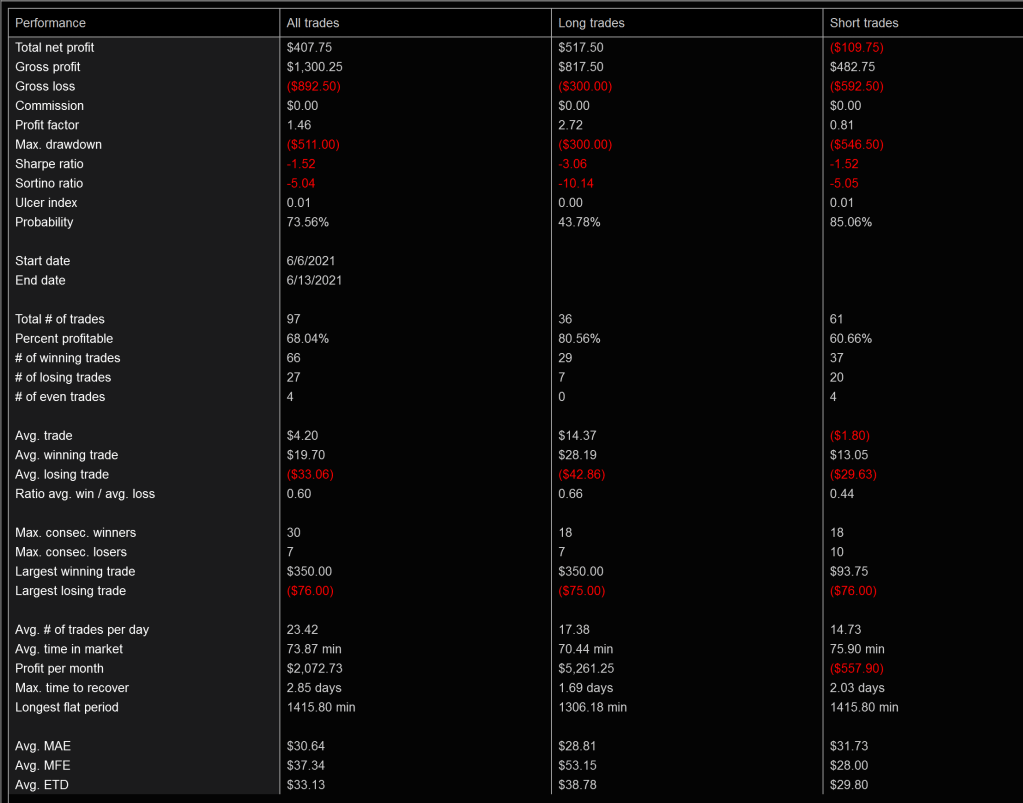

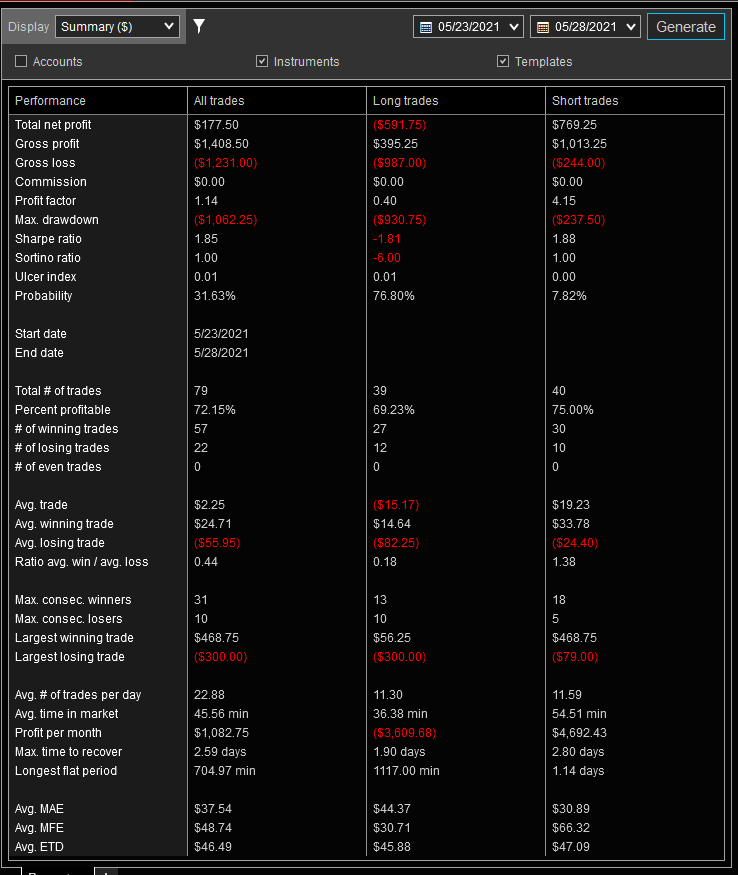

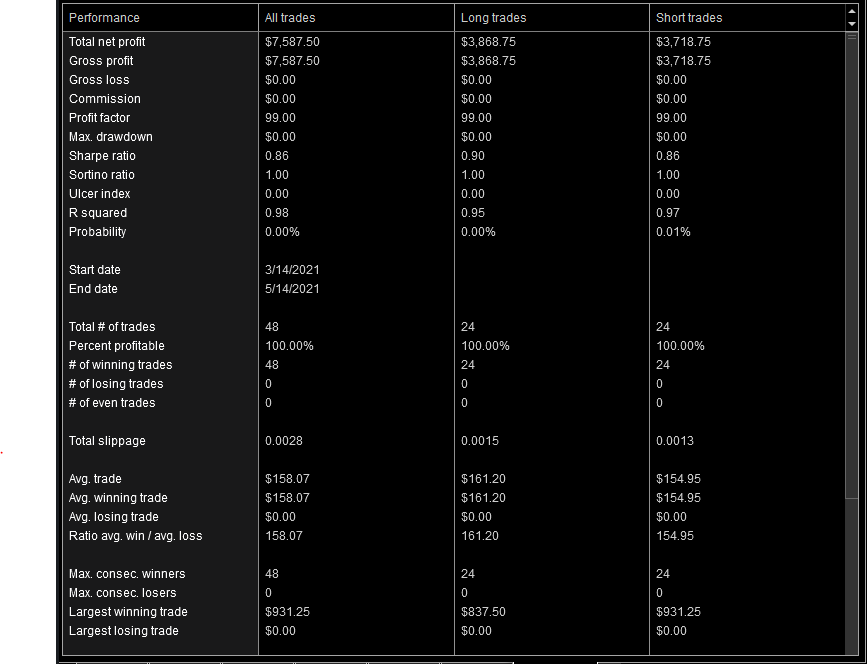

Another benefit of the service is the trading room that is run through Slack, its a area for easy community idea sharing, learning, encouragement, etc.. As an example of this just last week one of the algo users posted that they were having great success with a Renko bar strategy. He openly shared this with the group and I have since tweaked it some and have been testing, the results from the past week are really exciting:

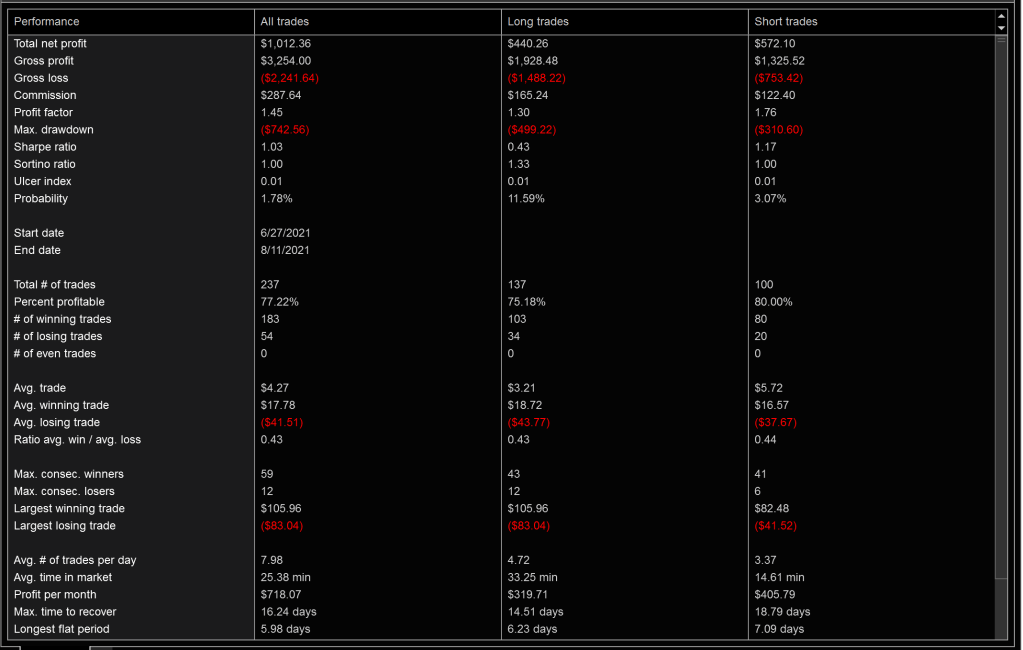

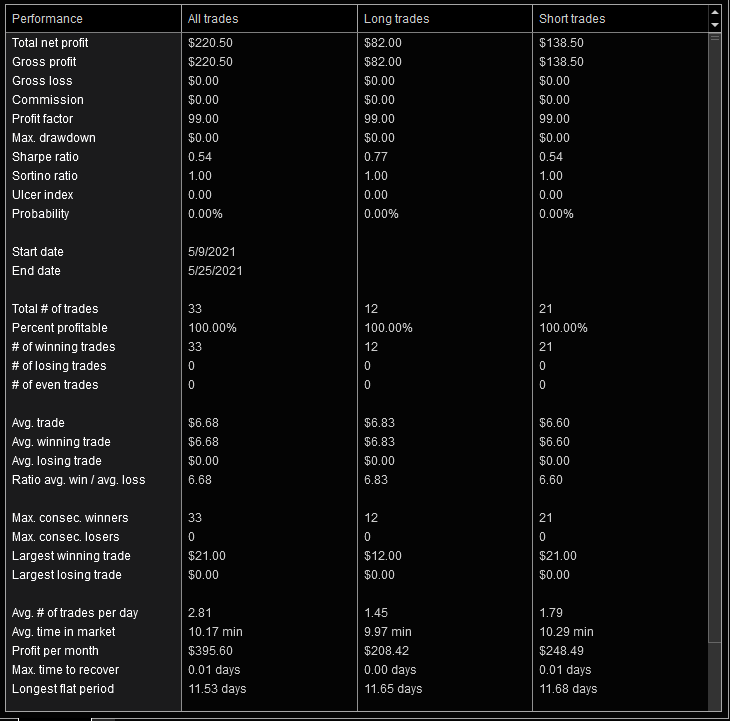

I will be trading this live starting next week, will also be doing some testing of some adjusted settings at the same time. Looking at the numbers with the new mindset the max winning trade was $150 and max losing trade was $26.25, the average win was $23 and average loss was $20, even at 50% win rate this would be considered a good setup but the win rate was 60%.

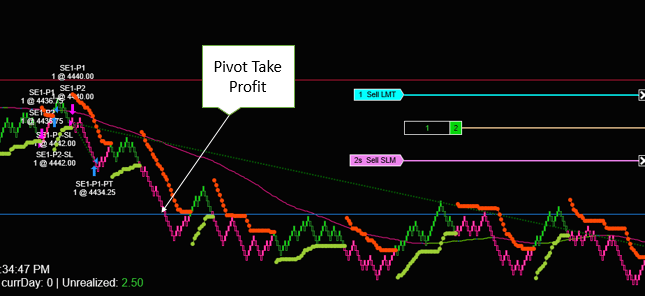

The plan for next week is to run these settings live as is with no changes, I will be testing the following tweaks to optimize a bit further from looking at the charts and trades:

- Adding a third contract, will close contract and take profit at a key Pivot Point (New feature on Algo)

- I will be setting the 3rd and final contract to close with a trailing stop, this is what I call a runner contract as the trail is far enough back to stay in the trade as long as its still in a long trend

- Reduce number of trades, winners and losers, but also less commissions

- Maximize profits only giving back delta from peak to Trailing stop

- Will test / look at different values for stop loss and taking profit on contract one

All in all I am super excited about this algo and these settings for sure, so grateful for the community and product that AlgoNinja has put together. If you are interested in trying the product please click the AlgoNinja link or use discount code Honest50 and you will get a 50% discount off of your first month of membership, I hope to see you join the team, we are on a path to life changing profits.