It is hard to believe that it has been a year and a half since I had posted last, I still need to go back and read some of my last posts but I do recall the reasons well.

This past year certainly has been eventful both in my personal and professional life. I do recall stepping away as my full time job became very taxing with time and emotionally, on the personal side I also took on the purchase of a home and full renovation.

As I sit here today life has calmed some, the house is getting close to complete, work life is what it is but is far less demanding of my time. I have also taken time in the past year to focus on my physical and mental health, both of which have greatly improved.

My plan moving forward is to continue on my trading path, that is still the long term goal but also to explore other entrepreneurial avenues for financial independence. I will use this blog to document my path along the way that others can benefit from the journey. You will see the site change to include products that I have found in the past year that I have tried tested and and helped.

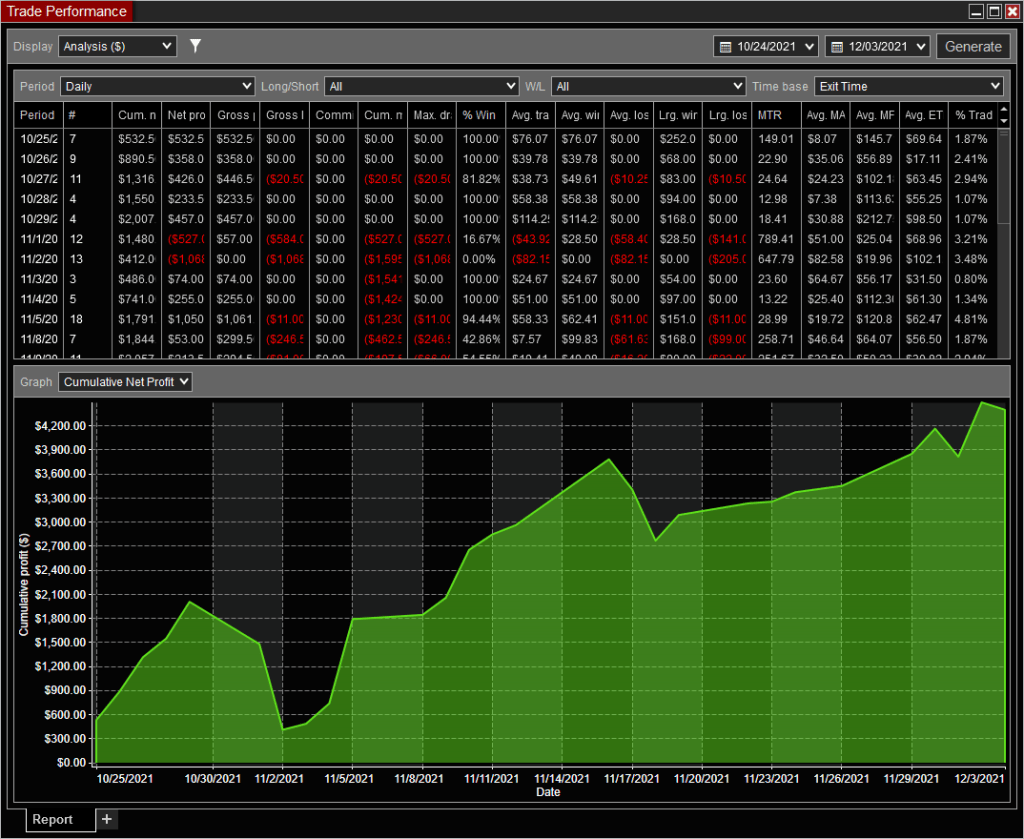

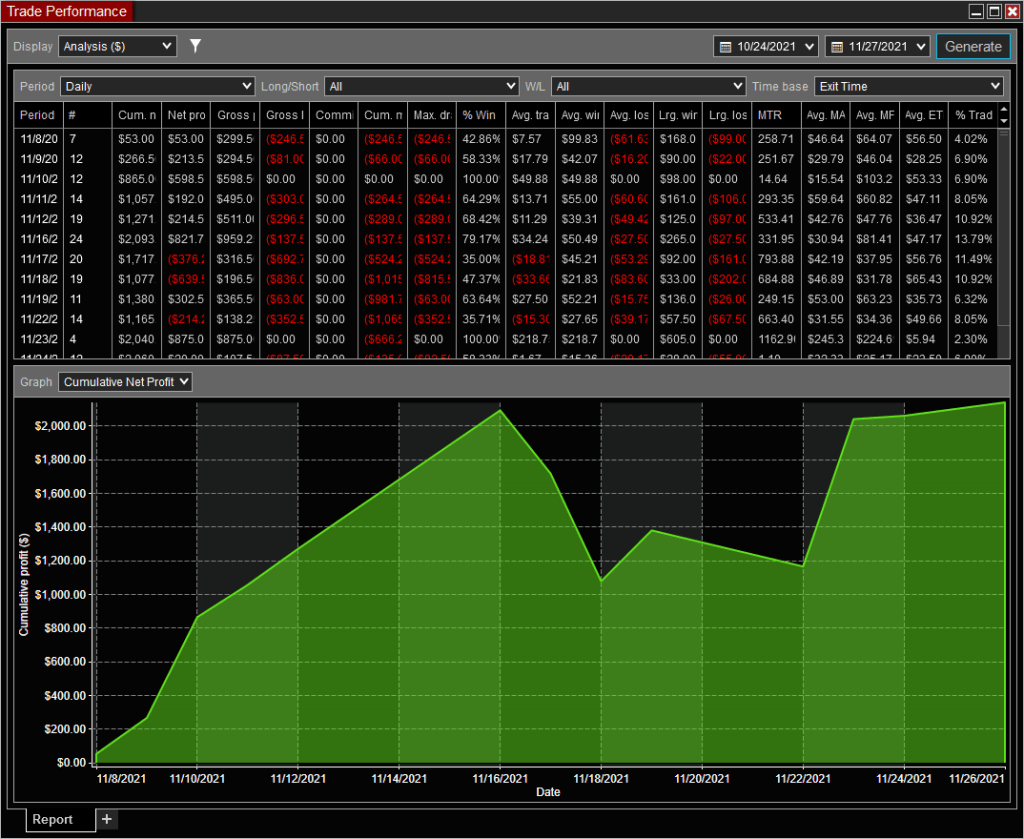

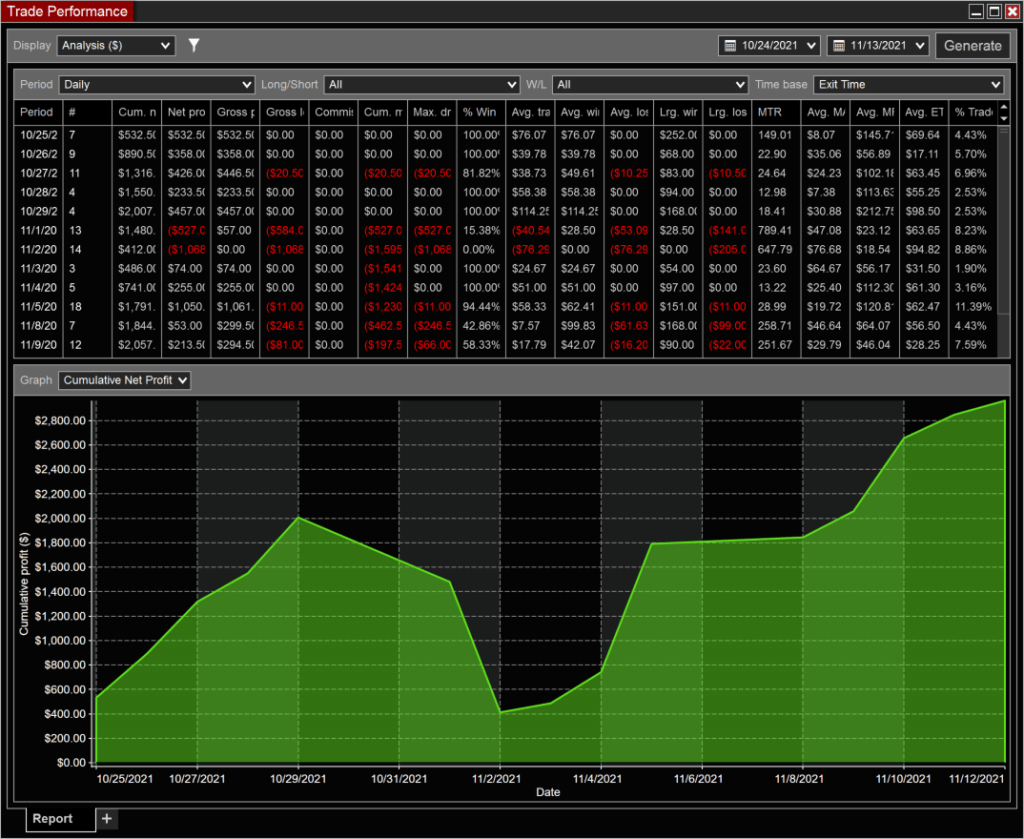

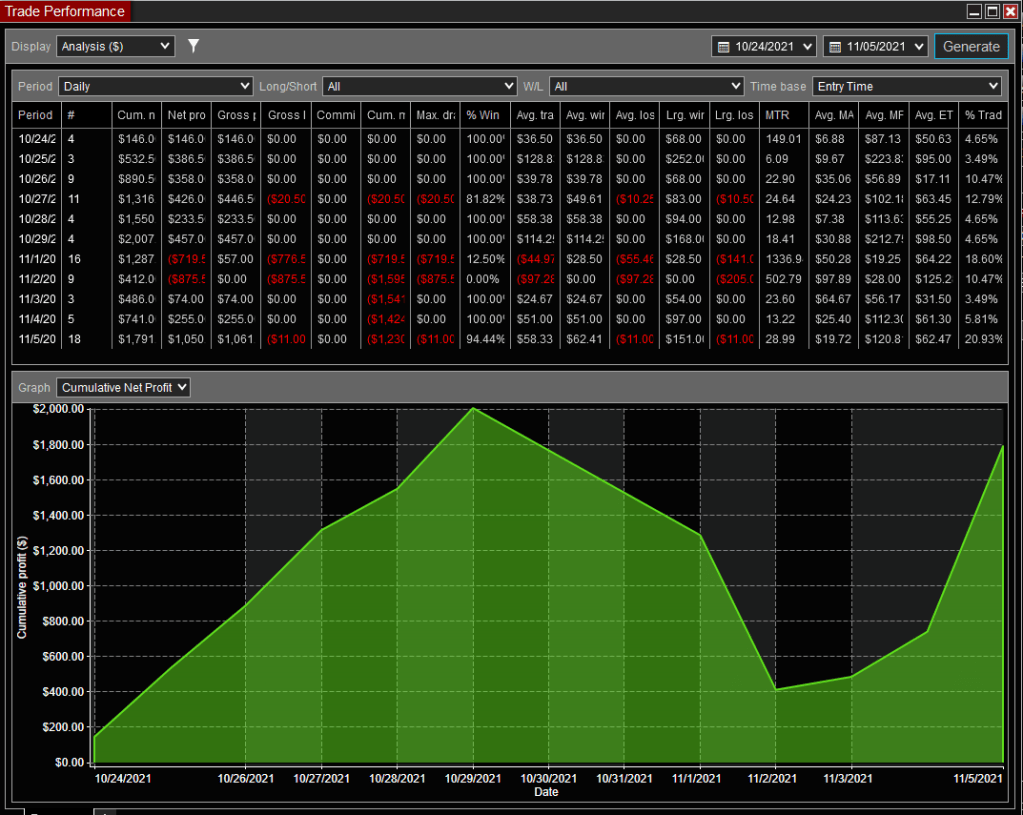

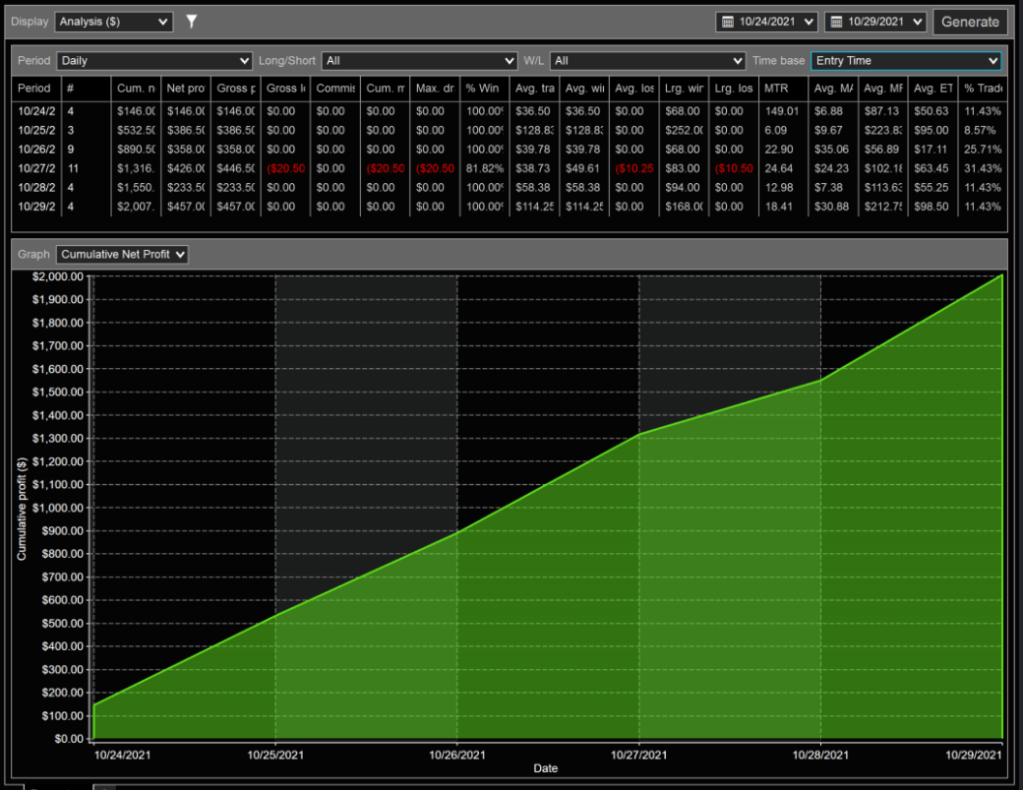

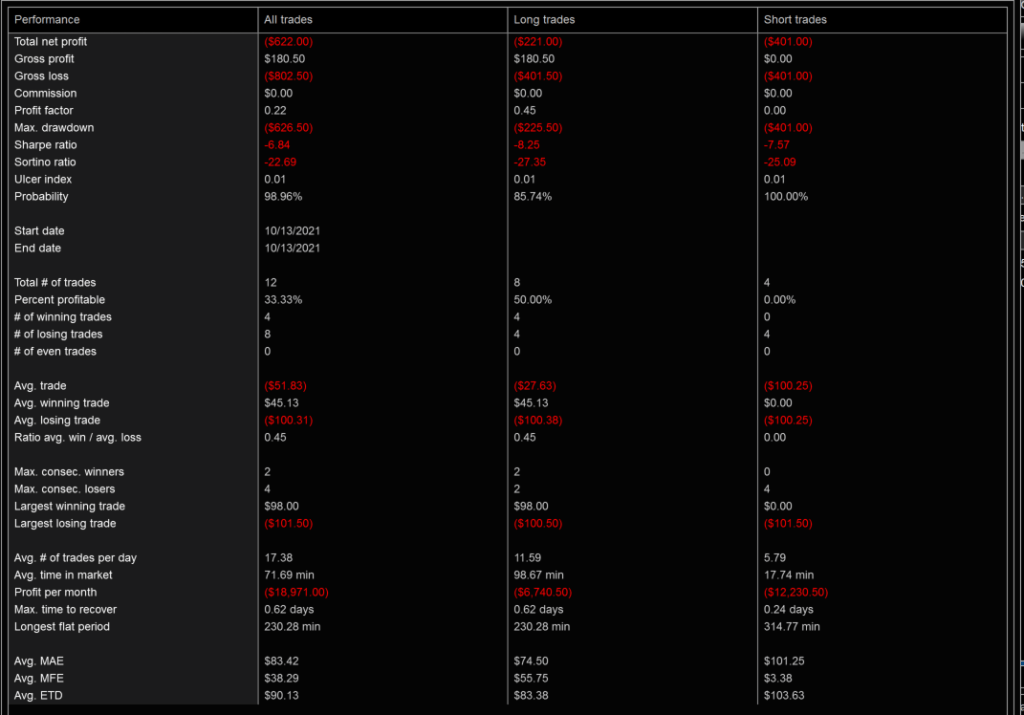

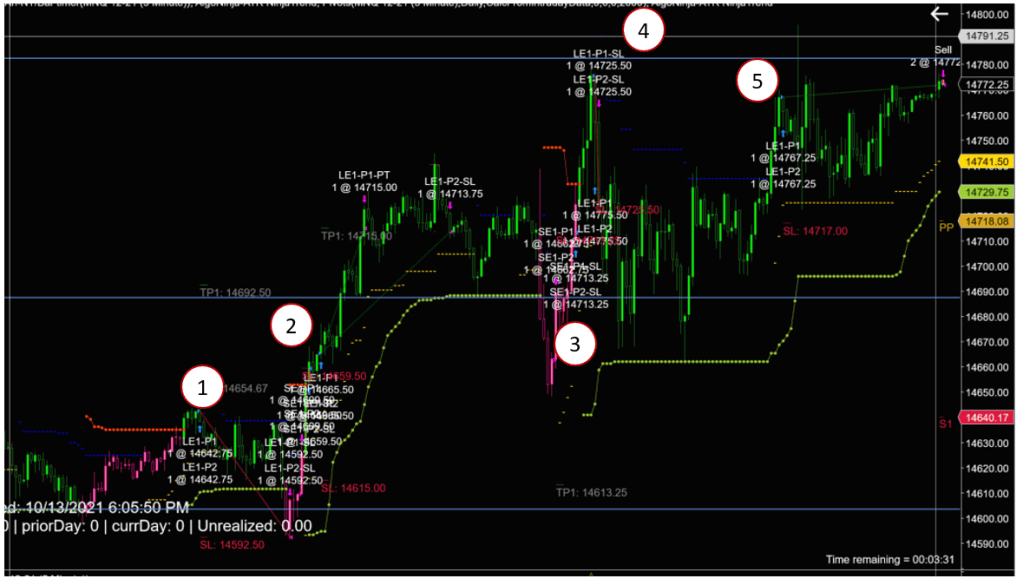

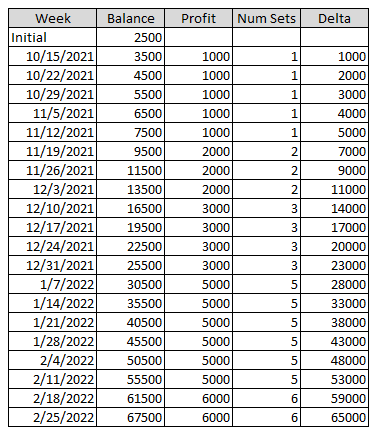

On the Futures trading side I have been doing some Algo testing of the AlgoNinja product and I am running some settings in a live environment against a SIM account. So far the results are positive, I will document this more in the coming days. I have also continued to learn more about trading without Algos as I feel this is most likely the end game for myself.

Stay Tuned and God Bless.