It is amazing to me sometimes how much you learn, forget and then relearn on the trading of futures. In particular for trading algos and finding the correct settings, time frames to optimize, trust the output and what to trust.

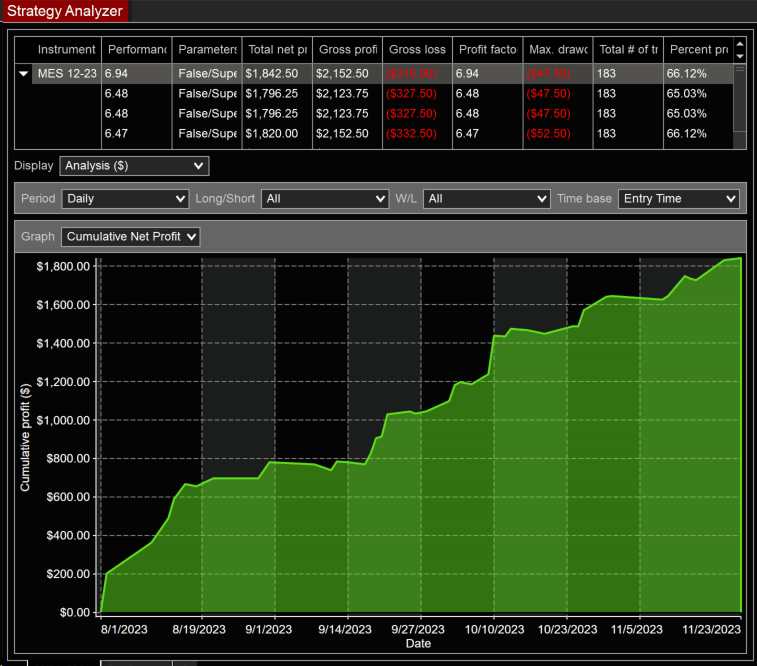

Having said this the initial settings that I had tested and validated in SIM trading, those did produce good results for a period, the market did shift and those settings have been more or less flat since. I have since moved to optimizing on a 90 to 120 day window, making the settings more sensitive to current market conditions. The results of the settings are using now are:

This is now my active settings, will be tracking actual to projected, starting with 3 profit points at 1 contract each. I have also worked on a scaling plan to increase the number of contracts as the account grows, accounting for a max of 10% risk per trade.

I will be reviewing these settings a couple times a month to determine market shift, still learning and adapting.